By Daniel Johnson

Black Enterprise

Reprinted – by Texas Metro News

https://www.blackenterprise.com/

Despite its current surge, some reports indicate bitcoin has failed Black communities.

Following the election of Donald Trump, Bitcoin, as well as other cryptocurrencies, have been surging; and Bitcoin in particular has been forecast to post its best month since February as it rides the post-election high.

According to CNBC, Bitcoin was forecast by Coin Metrics to post a 38% gain for the month of November, which trails only the mark of a 45% gain it posted in February.

As BLACK ENTERPRISE previously reported, Bitcoin and other cryptocurrency investors have been bullish on the prospect of another Trump administration being extremely friendly to cryptocurrency after previously being hostile to it.

However, Bitcoin and other cryptocurrencies depend on a practice known as energy mining, which, as Capital B News reported in July, can leave Black communities already imperiled by climate change even more vulnerable.

According to Brittany Stredic, a member of a coalition of Houstonians fighting a pipeline and gas plant in her neighborhood, the plant is an unnecessary disruption.

“They’re (the State of Texas) trying to use these ‘volatile’ climate events, the freeze and the heat, as justification for all these new gas plants. But we don’t need it,” she told the outlet.

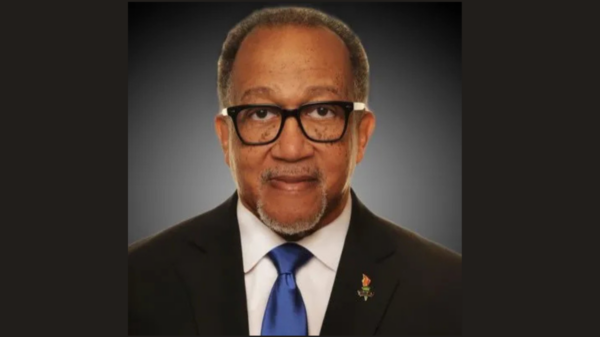

Algernon Austin, director for Race and Economic Justice at the Center for Economic and Policy Research, highlighted how the cryptocurrency industry leverages its wealth to lobby for favorable policies, often at the expense of the country’s most vulnerable populations.

“There are so many downsides to crypto, but unfortunately, the industry has a lot of money, and have recently been using their money to get favorable policies in Washington, D.C., and places like Texas,” Austin told Capital B News. Austin continued, “Cryptocurrencies are a shiny new way to lose money. Analyses that have been done suggest that, if anything, it’s worked to increase inequality. It’s worrying that it is creating a problem environmentally on top of all of this.”

In 2023, Vox reported that crypto had failed Black communities, despite part of its pitch to those communities being that cryptocurrency could be a lifeline for wealth building outside of more traditional means.

“The idea that crypto is somehow providing an avenue that’s easier than other forms doesn’t pan out. It’s not as democratizing and welcoming as suggested,” Austin told Vox. “The crypto industry is concerned about the crypto industry, it’s not concerned about Black wealth.”

Mehrsa Baradaran, a law professor at the University of California Irvine and expert on financial inequality and the racial wealth gap, compared the cryptocurrency industry’s pitch to Black Americans to other predatory financial schemes historically targeted at Black communities.

“You have the perfect conditions that led to the Freedman’s Bank, that led to the subprime crisis, that led to the contract sales after the New Deal, which is that capitalism is undergoing some shift and something is wrong and the government needs to handle it, but instead, they leave out certain people and then some terrible, exploitative incentive gets born, and someone is always going to step into that. It is a looting of people’s money,” Baradaran told Vox.

Baradaran continued, arguing that a more tenable solution is to fix what’s broken rather than hoping for something with little to no oversight to become a magic pill for building wealth.

“This is what you see with bitcoin, you get the scammers and the hucksters and the fraud, people who come in and say, ‘Look, we’re going to exploit people’s genuine desire to build wealth in a f***ed-up system,” Baradaran said.

She concluded, “If the system’s broken, let’s fix it, instead of saying, ‘Look, the system’s broken, let’s create this other system. It’s losing all the lessons that we had to learn the hard way in this financial system, which is that you need trust, you have to have trust. And if we allow fraud without regulation, there will always be fraud.”

Austin, meanwhile, underscored the insidious nature of selling Black people what some say is a false bill of goods.

“It’s important to recognize that the Black population has more economic hardship and economic insecurity than the white population or the US population overall on average. You have more poverty, higher rates of debt, higher rates of insecurity, unstable work hours, unaffordable housing, there are a number of financial stresses in the lives of many African Americans,” Austin told Vox. “So when you’re worrying how you’re going to pay your bills regularly and how you’re going to get ahead and someone shows up and says, ‘I have the solution, and this will help you pay all your bills and help you pay your kids’ college and the house that you’ve always dreamed about,’ that’s pretty enticing.”

You must be logged in to post a comment Login