By Bria Overs

Parents want the best for their children — to see them thrive, graduate college, get a good job and start a family of their own. Young adults turn to their parents for advice and, on occasion, financial assistance to achieve these key milestones of adulthood.

Texas resident Kayla G., 28, is one of those young people. She used a full-ride scholarship to get through college, but her parents provided support — filling out her FAFSA and paying for groceries — while she completed her undergraduate degree. After graduation, she moved home rent-free, got a marketing job, earned a master’s degree and paid off her car.

While rent is not something she worries about, she does cover other expenses, including her phone bill, car insurance and health insurance.

“They definitely don’t just pay for everything, and I’m not living a complete ‘princess life’ over here,” she tells Word In Black. “But it is helpful. For all of my 20s, I’ve been able to save.”

According to the Pew Research Center, 23 percent of young adults in America say they are mostly financially independent, while 45 percent say they are completely independent from their parents. The study doesn’t break things down by race, but other research gives insights into the Black parent and Black young adulthood experience.

Links to the racial wealth gap

A 2021 study exploring the intersection of the Black-White wealth gap and parental financial assistance by researchers and professors at The New School and the State University of New York at Buffalo found that for some Black parents, giving money to their young adult children is quite difficult — through no fault of their own. Their ability to financially assist is not only affected by the long-standing racial wealth gap, but it can also contribute to its widening as well.

“The racial wealth gap is largely linked in an intergenerational way to policies and structures in which Black people have been excluded from,” says Darrick Hamilton, Henry Cohen professor of economics and urban policy and founding director of the Institute on Race, Power and Political Economy at The New School. In other words, it may be easier for White people to build and maintain wealth than it is for Black people because of government policies, for example, such as ineligibility for benefits from the G.I. Bill after World War II.

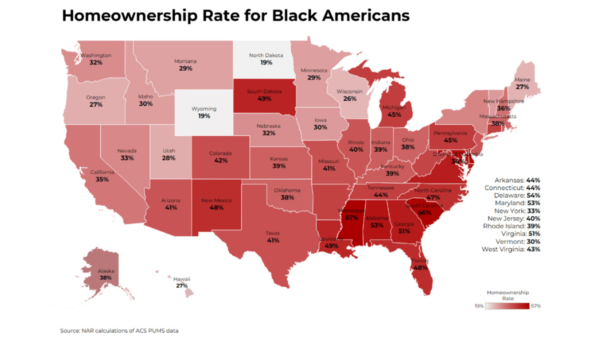

Black young adults are less likely to receive financial assistance from parents for education, homeownership, and other things than their White counterparts. 14 percent of Black people surveyed for the study reported receiving parental aid for college, 2 percent for homeownership, and nearly 20 percent for other reasons.

The researchers wrote these numbers are low in comparison to White survey takers, not because Black parents don’t want to help their children. The inability to give has more to do with the “socioeconomic position of Black parents,” and “in turn, translates into the intergenerational reproduction of the racial wealth gap.”

Effects of financial assistance for parents and their children

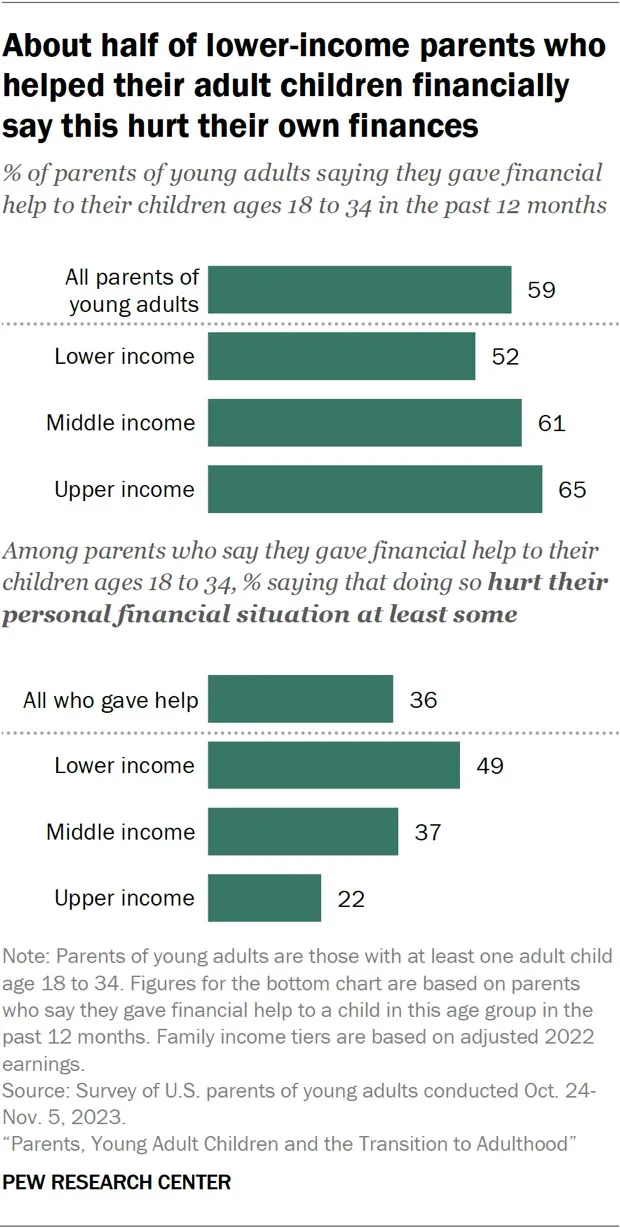

Low-income parents, especially, face trouble by providing aid. Nearly half of lower-income parents and 37 percent of middle-income parents said helping their young adult children financially hurt their own finances. In the reverse, though, a third of young adults said they were helping their parents and those with lower incomes were more likely to help.

Kayla’s three other siblings, who are in their 30s and mid-20s, also live at home. She says, in the past, her parents hadn’t expressed any issues with all six family members living under one roof. That is, until recently.

“Those conversations are happening, and there may be some shifts,” she says. “I can’t say they ever said they felt like we were taking money out of their pocket — not verbatim, at least — but I definitely feel like there’s starting to be a bit of financial strain because we’re all grown.”

On the flip side, that same 2021 study noted Black young adults fare better in terms of income and net worth when they have assistance from their parents. This has been the case for Kayla. She says thanks to her parents, she’s been able to “grow up slowly” and prepare for her 30s by learning how to budget, save and invest.

“I think that’s a really undervalued thing in our society because everyone’s so quick to grow up fast and jump right into the world,” she says. “Being home has allowed me to mature slowly. I feel like I’m much wiser about things like how I view money. I’m better prepared to kind of go out there, and when I’m ready because I’ve been able to save up, I can purchase my own place.”

This article was originally published by Word In Black.

You must be logged in to post a comment Login