Carolina Falcón bought a newly renovated, two-bedroom home with original hardwood flooring last year with her husband in Oak Cliff, the Dallas neighborhood where she grew up. She filled a faux fireplace with candles and a disco ball, and her husband’s houseplants pour from each corner.

The couple is nearing their first anniversary of homeownership, the most routine method of building generational wealth and the leading asset among Latinos. For Falcón, the purchase wasn’t just a milestone for her own financial future but a new mark in her family’s as well.

Of her immediate and extended relatives in North Texas, she’s the first to own a home.

“It feels like a dream,” Falcón, 26, said from her backyard. “When we first bought the house, I wanted to cry because I just never thought of myself at this age buying a house because it was so intimidating.”

She didn’t know how much to save, what the process looked like or how to outplay investors with all-cash offers.

Over the next two decades, Latinos are projected to account for 70% of homeownership growth nationally, with younger buyers stoking the increase. The Urban Institute, a nonprofit research group, forecasts Hispanic homeowners will grow by 4.8 million across the U.S. from 2020 to 2040.

In 2000, 4.2 million homes were owned by Latinos across the U.S., according to an annual report by the National Association of Hispanic Real Estate Professionals. More than two decades later, 8.8 million homes are owned by Latinos. In Dallas County, nearly a third of homeowners are Hispanic, according to the latest American Community Survey by the U.S. Census Bureau.

Falcón’s cousin Sarah Thwaites is a Realtor and a director of the Dallas chapter of the Hispanic real estate group. Thwaites was able to help Falcón dive into the market last year after Thanksgiving.

When starting their house hunt, Falcón and her husband saw a home they loved, but they lost it to investors who pitched $50,000 over the listing price. When a contract fell through on another house they toured, Thwaites stepped in. Before the turn of the year, the couple closed on a nearly 1,200-square-foot house for $300,000 — more than $50,000 less than the county’s average sale price.

“Now all the other cousins are stepping up,” said Thwaites, the oldest cousin of the family. “It’s started this effect. Our other cousins are now talking to me about buying their first home and setting up their financial future.”

Thwaites has herself been under contract to buy a home three times now, most recently postponed by concerns about careing for a family member. Now, she’s closely monitoring interest rates for the right time to buy.

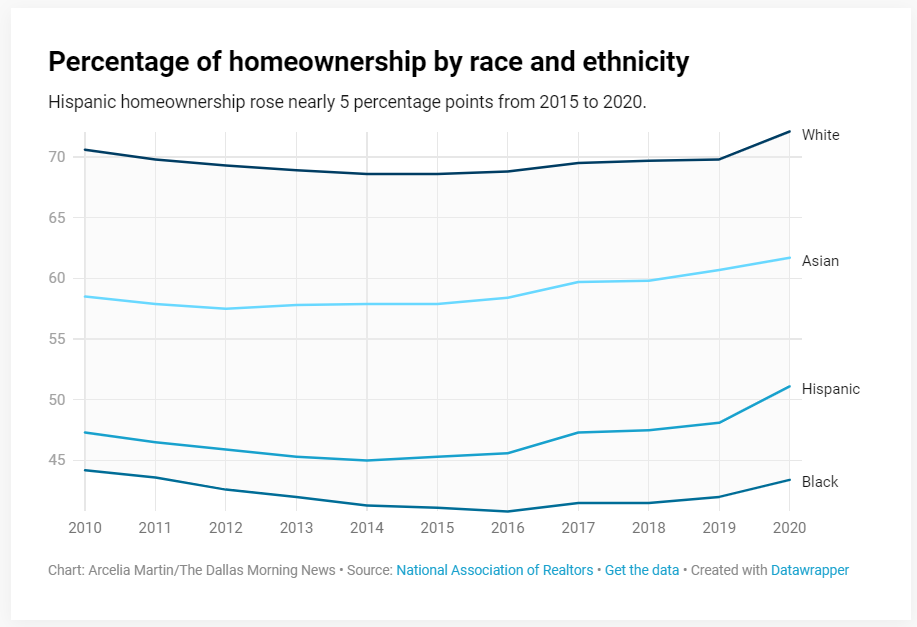

Despite the anticipated growth in homeownership among Latinos, data shows continued gaps in rates between race and ethnicities.

Nearly three-quarters of white households owned homes in 2020, according to a 2022 National Association of Realtors report, compared with 62% of Asian households, 51% of Hispanic households and 42% of Black households.

Some companies are working to make homeownership more accessible for Black and Latino communities, groups with the lowest rates of ownership. Bank of America chose Dallas as one of five cities to pilot a new nationwide program aimed at helping first-time homebuyers. The Community Affordable Loan Solution offers home loans with no down payment or closing costs.

In the Dallas area, Thwaites said the top three obstacles she sees among first-time Latino buyers are down payments, a lack of available housing and rising interest rates.

She routinely hears from families who were taken advantage of due to a language barrier, such as scam programs that charge Spanish-speakers for what are otherwise free resources, she said. Part of her role at the Hispanic real estate group is to distribute homebuying resources to the Latino community for free.

“We get in front of as many people in our community as possible to make sure we’re educating all of these people in real estate so we can make generational wealth possible for the Hispanic population,” Thwaites said.

White families have the highest level of median wealth, at $188,200, according to a 2019 Federal Reserve survey of consumer finances. Black and Hispanic families have considerably less wealth than white families, according to the survey.

Black families’ median wealth is $24,100 and Hispanic families’ median wealth is $36,100. Families identifying as Asian, American Indian and all respondents reporting more than one race have lower wealth than white families but higher wealth than Black and Hispanic families.

Jun Zhu, a fellow at Urban Institute’s Housing Finance Policy Center, said an increase in down payment assistance and financial literacy can support the growth of Hispanic homeownership.

“Financial education is important because there’s significant misinformation,” Zhu said.

Zhu said there ought to be efforts to re-examine how borrowers are qualified for mortgages, accepting a variety of tax documents to create more access for Latinos to buy homes.

Victor Toledo’s real estate firm, Greenleaf Ventures, works primarily in West Dallas to build homes local families can afford, especially low- to moderate-income families. At one of the firm’s latest projects at Trinity West, the 115 homes’ estimated value at initial closing was nearly $324,000. Each home is projected to create nearly $34,000 in added value in two years based on the assumption that the area’s home prices increase by 3.5% annually.

“It’s a life-changing transaction for them,” Toledo said at a tour of the development.

Toledo views the homes not only as a way to build wealth but as a stepping stone to a family’s future home purchase.

“We have a constant need to keep producing more housing stock because we so desperately need it,” Toledo said.

One-third of Latinos’ existing wealth is attributed to home equity, the largest share of any asset category for the group, according to a 2022 State of Hispanic Wealth report. In 2021, more than 735,000 home purchase loans were originated to Latinos, a 13% jump from the previous year.

Latinos are the youngest of any racial or ethnic demographic, at a median age of 30, so the group is seen as in their prime for homebuying. The median age for all first-time homebuyers was 33 in 2021.

In the 10 most populous Latino markets, a shortage of housing significantly worsened from 2012 to 2019, the real estate report said. Texas and Florida, two states housing more than a quarter of the nation’s Latinos, showed the steepest increases in a lack of construction.

Last year alone, more than 17,000 Latinos moved to Texas, according to a report by the Hispanic real estate group. In Texas, according to its findings, the cities ofMcAllen, El Paso and Brownsville offer the greatest opportunities for Latino homeownership growth.

From her side deck, Falcón maps out renovation projects she plans to undertake. She’ll extend out the driveway to the yard, maybe build out a two-car garage and a granny flat, just beside a towering pecan tree.

Since her purchase, Falcón’s Oak Cliff home has hosted nearly every family gathering — a backyard Labor Day, an early Halloween party. Next, the home will hold its first Thanksgiving dinner. Falcón plans to end it with a homemade pecan pie.

You must be logged in to post a comment Login